Please Call 1-800-390-8083 Accomodators & Qualified Intermediaries (QI)The Role of Qualified Intermediary (QI) In A 1031 "Like Kind" Exchange

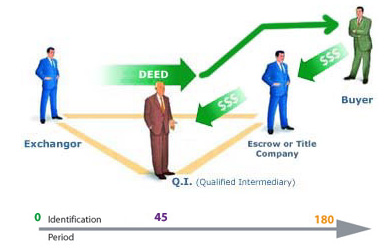

The (QI), also known as a facilitator or exchange accommodator the Qualified Intermediary (QI) serves a crucial function under the Internal Revenue (IRS) Code. Choosing an Intermediary to facilitate the 1031 exchange is usually the first and one of the most important steps. The Qualified Intermediary (QI) should be a company that works on a full-time business of facilitating 1031 exchanges. The Internal Revenue (IRS) Code requires that the person or entity serving as (QI) cannot be someone with whom the exchanger has had a former business or family relationship prior to the transaction. The IRS code is clear in the fact that a (QI) has to be an independent organization whose only contact with the exchanger is to serve him as a Qualified Intermediary (QI). A Qualified Intermediary (QI) must be used to facilitate the 1031 Exchange Transaction and as a matter of fact, by definition, a 1031 Qualified Intermediary (QI) is an independent and professional facilitator who receives the funds. He handles the funds from the original sale and holds the funds until they are needed to purchase the new exchange (replacement) property. The Qualified Intermediary (QI) then directly delivers the money to the closing agent who then, in turn, delivers the deed directly to the real estate investor himself. A Qualified Intermediary is responsible for performing the following activities in a 1031 Exchange:

An exchanger must be particularly aware of selecting a knowledgeable (QI) before going into the transaction. There are thousands of (QI) providing "like-kind" 1031 exchange services today. Most of the Qualified Intermediary don't have the necessary insurance, financial backing, bonding, transactional structure, and internal safety controls that should be required of them. Even most exchange funds are often grossly under-insured, under-protected, and are at risk. In today's risky economic climate, choosing a financially secure, 1031 (QI) with the financial strength, resources, safeguards, and financial backing is critical for the safe completion of a 1031 "like-kind" exchange transaction with a Qualified Intermediary. Is it necessary to select a QI that has Fidelity Bond Insurance? Yes, always make sure your QI is bonded and insured. 4 Things to Concern Yourself with Before Selecting a Good QI Disclaimer: 1031 exchange made simple does not guarantee the performance of the QI's in our referral network and we can not be held liable for any misrepresentations or mistakes in regards to a 1031 exchange by one of the QI's that we refer to you. 1031 Exchange made simple does not provide tax advice nor can we make representations regarding the tax consequences of an exchange transaction. 1031 Exchange made simple is a 1031 QI Referral Network. 1031 made simple is not responsible (in any way) for the performance, creditability, and financial condition of any QI in our network. In this new economic environment it is imperative that all potential 1031 exchange customers do their own due diligence and research on any QI that they may use, on a 1031 exchange. Please verify and check the validity of the Bonding and Insurance of your QI. It may be wise to have your 1031 exchange accounts set up as separate, individual customer accounts. Our web site is to be used as a information based web site only. All parties doing a 1031 exchange must consult their tax advisors or attorney for this information.

If you are a fully licensed Qualified Intermediary and would like to be evaluated and possibly added to our network of QI state and local providers, please call us today at: 1-800-390-8083 1031 And Personal Residence | 1031 Do's and Don'ts | 1031 Exchange Boot | 1031 Triple Net Lease | Reverse 1031 Exchange | Contact |

|

"The opinions set forth in this website are subject to the disclaimer pertaining to IRS Circular 230 set forth herein." Unless expressly stated otherwise on this website, (1) nothing contained in this website was intended or written to be used, can be used by any taxpayer, or may be relied upon or used by any taxpayer for the purposes of avoiding penalties that may be imposed on the taxpayer under the Internal Revenue Code of 1986, as amended; (2) any written statement contained on this website relating to any federal tax transaction or matter may not be used by any person to support the promotion or marketing or to recommend any federal tax transaction or matter; and (3) any taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor with respect to any federal tax transaction or matter contained in this website. No one, without our express written permission, may use any part of this website in promoting, marketing or recommending an arrangement relating to any federal tax matter to one or more taxpayers. |

| 1031 Exchange Made Simple An Independent 1031 Referral Network Phone: 1- 800-390-8083 (Calls go to an FEA Member) |

|

1031 EXCHANGE © COPYRIGHT 2006-2018 ALL RIGHTS RESERVED 1031EXCHANGEMADESIMPLE.COM |

Section 1031 of the Internal Revenue Code (IRC) offers a great opportunity for real estate buyers to defer the capital gains tax liability associated with the sale of a business or investment asset. The 1031 exchange ensures the maximum return on investments to people of all financial backgrounds. To qualify for 1031 "like kind" property exchange the entire transaction has to be done in accordance to the detailed rules, regulations and compliance issues set forth in the US (IRS) tax code.

Section 1031 of the Internal Revenue Code (IRC) offers a great opportunity for real estate buyers to defer the capital gains tax liability associated with the sale of a business or investment asset. The 1031 exchange ensures the maximum return on investments to people of all financial backgrounds. To qualify for 1031 "like kind" property exchange the entire transaction has to be done in accordance to the detailed rules, regulations and compliance issues set forth in the US (IRS) tax code.